How do you figure out whether weekly, bi-weekly, semi-weekly—or even a combination of the three—would be the most optimal pay period schedule for your business?

Factors like employee preferences and labor laws are obvious considerations. But you also want a frequency that attracts and retains top performers and balances administrative costs with talent management goals.

Don’t worry, it isn’t as complicated as it sounds. Read on as I discuss the basics of pay periods, as well as tools and tips to help you improve your payroll.

What Are Pay Periods?

Pay periods are recurring lengths of time over which employee wages are calculated and paid.

The Fair Labor Standards Act (FLSA) has made it mandatory for businesses to pay employees on their “regular payday.“ But it hasn’t specified how often these paydays must come. States have taken matters into their own hands and set standards through payday frequency laws.

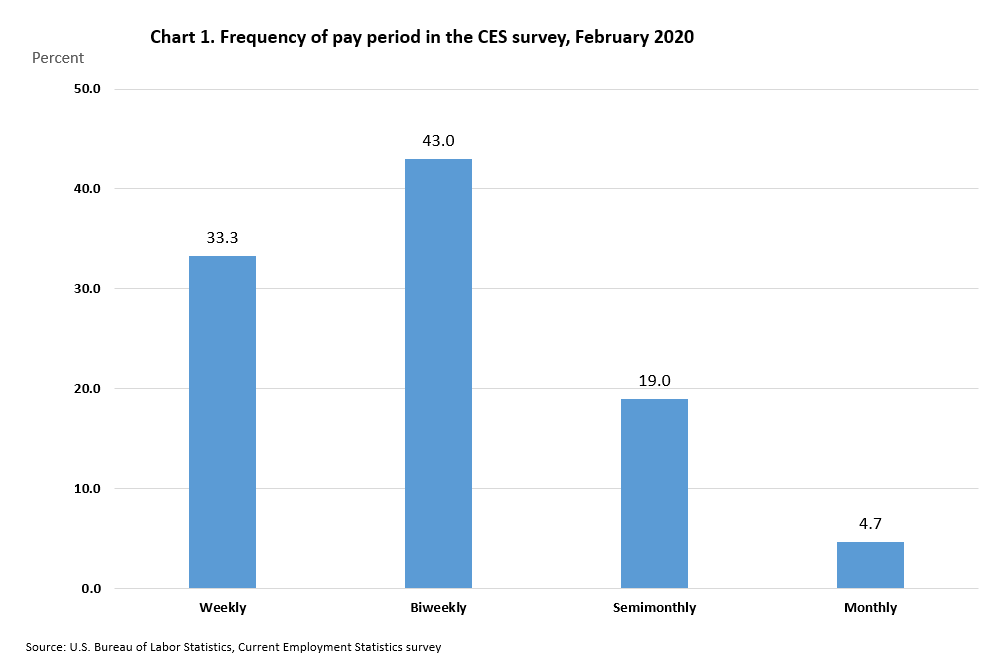

The most common pay periods are weekly, biweekly, semi-monthly, and monthly. While paying semi-monthly is still deemed acceptable, no state allows bi-monthly pay schedules at the moment.

How often you pay employees is a crucial decision because it directly affects recruiting and retention. It also means you should always be able to deliver paychecks consistently based on the schedule you select.

Missing payday, even by a day or two, can lead to employee resentment and opens you … Read More