Most businesses need an EIN to operate. If you’re starting a new business, getting an EIN should be at the top of your to-do list.

Think of an EIN like a social security number—but for your business.

You need a social security number to rent or buy a house, get a job, and open a personal bank account. EINs are just like that. You won’t be able to hire employees, form certain entities, or open a business checking account without an EIN.

Fortunately, getting an EIN is relatively simple. There are several different ways to do it, and you can even get an EIN for free.

Not sure if you need an EIN? Don’t know how to get one? You’ve come to the right place. This guide will walk you through everything you need to know about getting an EIN for your business.

What is an EIN?

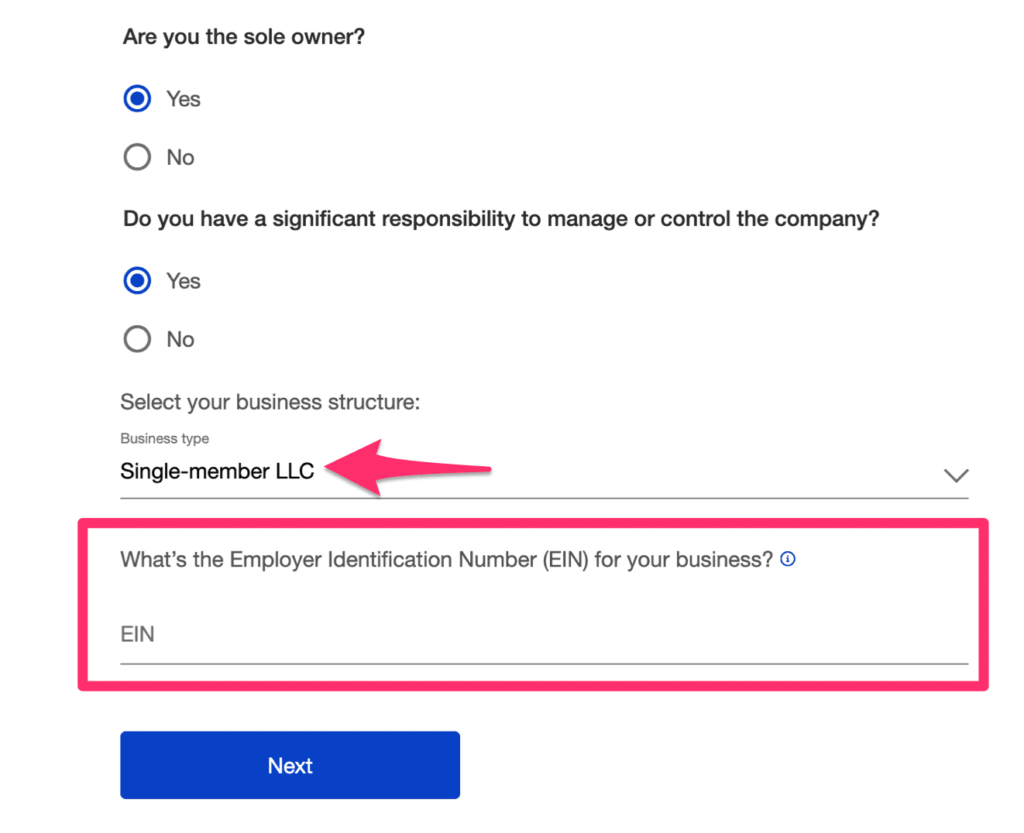

The acronym stands for “employer identification number” and is a type of taxpayer identification number (TIN). EINs get issued by the IRS to business entities like LLCs and corporations.

The primary purpose of these unique nine-digit numbers is for tax reporting. But most banks, credit card companies, and vendors will require your business to have an EIN before allowing you to open an account or working with you.

People often confuse EINs and social security numbers (SSNs) with each other, as they are both nine-digit government-issued identification numbers. But the formatting for an EIN is different from an SSN. EINs start with two digits, followed … Read More