Running payroll can be a challenge, especially if you’re a beginner or don’t have a dedicated payroll department.

Between federal income tax, state income tax, Social Security, and other payroll deductions, there are lots of things to keep track of.

You need to make sure that payroll is set up and processed accurately to remain compliant with the law. Beyond compliance, accurately processing payroll keeps your employees happy.

Fortunately, there are tools out there that take the guesswork out of the payroll process.

This guide will teach you how to set up and run payroll with ease, no matter your experience level.

The Easy Parts of Doing Payroll

Believe it or not, the easiest part of doing payroll is getting started. Lots of people struggle with this because they think it’s intimidating and don’t know where to begin.

But if you’re using an online payroll service, the process is pretty seamless and straightforward.

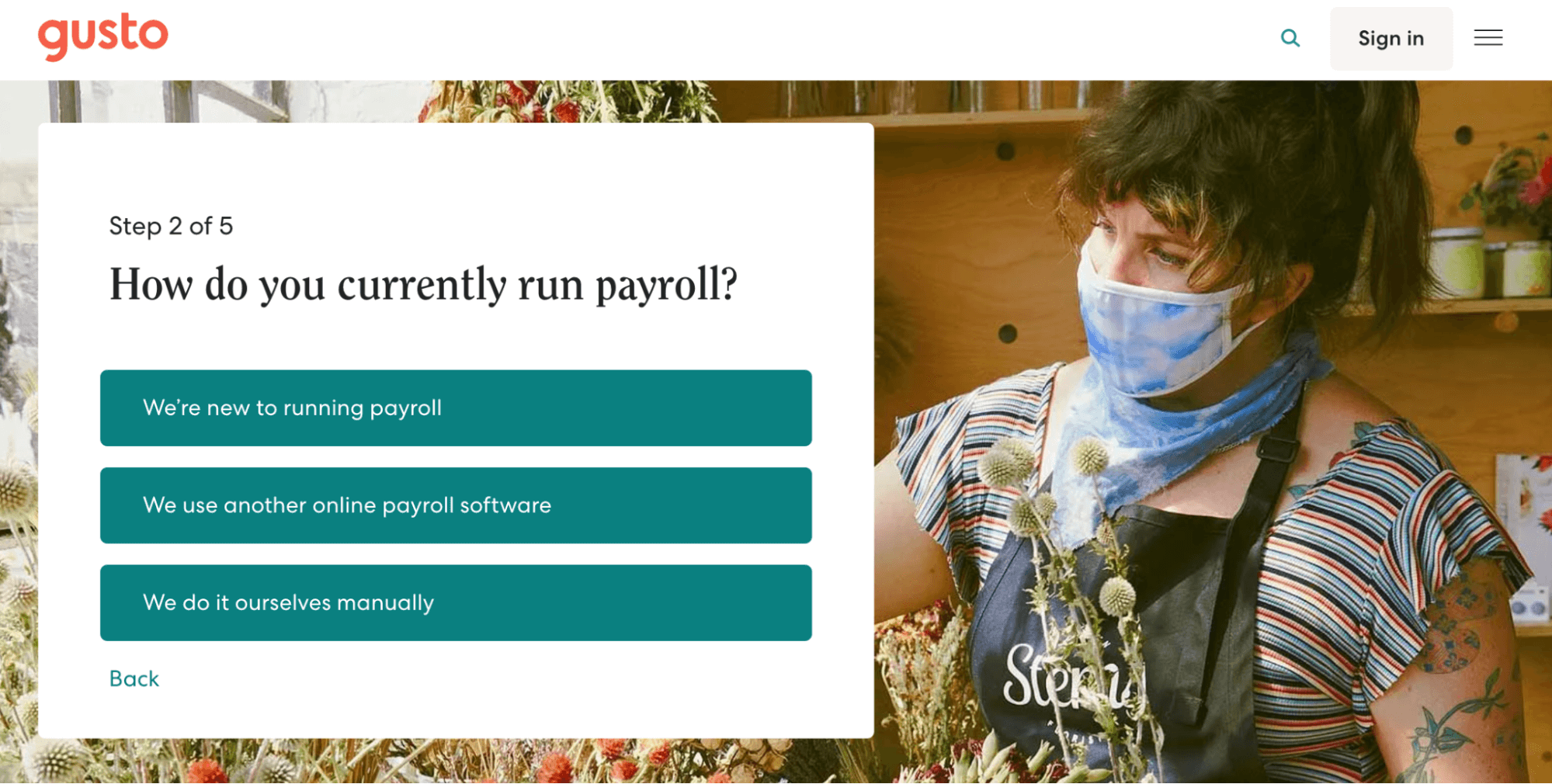

Gusto is a great option to consider here. You just need to answer a few simple questions about your business and employees to get started.

Since everything is online, you can set up self-service onboarding for your employees. This really takes a lot of the workload off of your shoulders.

Calculating payroll taxes and filing them with the appropria… Read More